Nikoo Samadi

Managing financial operations can often feel overwhelming. Between handling invoices, tracking expenses, and managing approvals, many businesses struggle to keep up. The BILL Financial Operations Platform for Microsoft D365 Business Central offers a way to make this process simpler and more organized.

In this blog, we’ll explain what the BILL Financial Operations Platform is, how it works, and why it could be a smart addition to your Microsoft environment.

What is the BILL Financial Operations Platform?

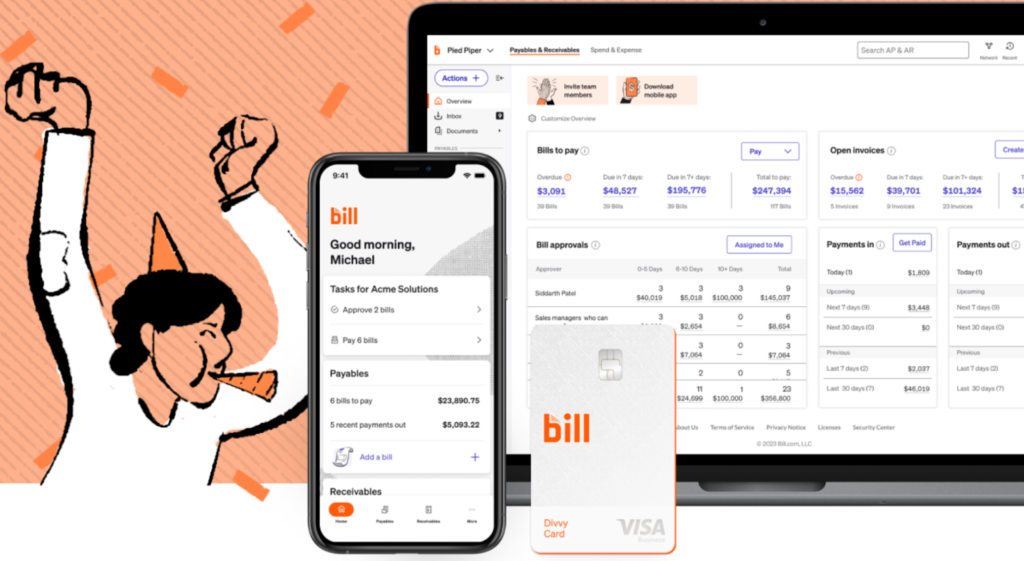

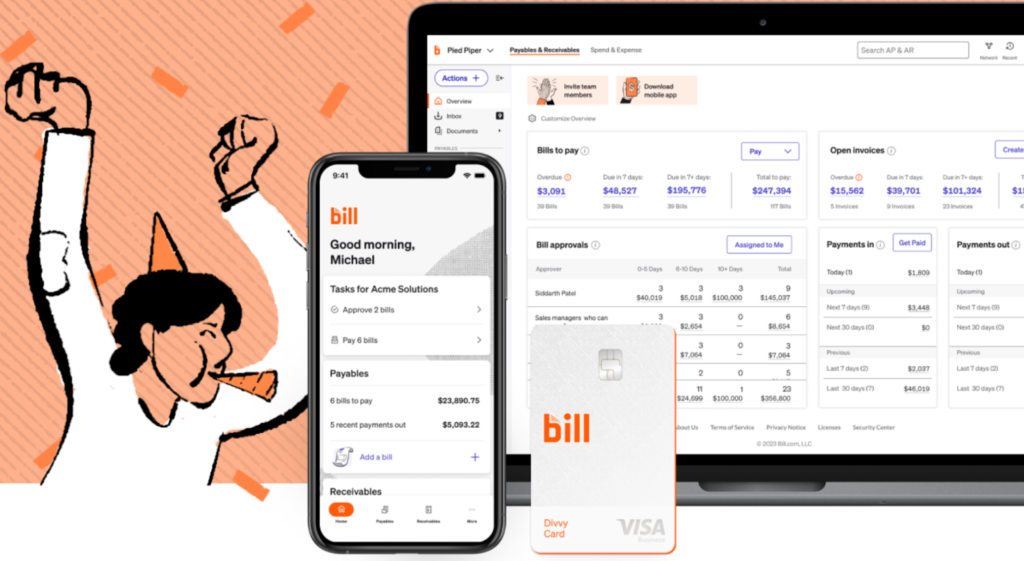

The BILL Financial Operations Platform is a tool designed to automate and streamline financial tasks. It extends Microsoft solutions like Dynamics 365 and Business Central by adding capabilities for accounts payable, accounts receivable, and spend management.

Instead of relying on manual processes or disconnected systems, BILL centralizes financial data. This helps finance teams cut down on errors, speed up approvals, and improve visibility into cash flow.

How BILL Integrates with Microsoft Solutions

The BILL Financial Operations Platform for Microsoft connects directly to core systems businesses already use. Through integration with Microsoft Dynamics 365, Business Central, and other tools, it syncs financial data in real-time.

When you create an invoice in BILL, it can automatically update your records in Dynamics 365. When you approve a payment, the system reflects it across your finance applications. This reduces the need for manual data entry and improves accuracy.

The platform also supports automated workflows. For example, you can set up rules for invoice approvals, expense reporting, and payment scheduling. These workflows can align with the structures and hierarchies you already have in place within Microsoft.

Key Features of the BILL Financial Operations Platform

Here are some of the core features businesses can expect when using the BILL Platform:

- Automated Accounts Payable: Capture invoices, route them for approval, and schedule payments automatically.

- Accounts Receivable Management: Create and send invoices, receive payments, and reconcile accounts.

- Spend Control: Track company expenses and set spending limits.

- Real-Time Reporting: Gain insights into cash flow, outstanding invoices, and payment history.

- Secure Payment Processing: Manage ACH transfers, checks, and virtual card payments through one system.

- Audit-Ready Records: Maintain a clear record of financial transactions to help with audits and compliance.

These features make daily financial tasks more predictable and less time-consuming.

Why Businesses Use BILL with Microsoft

Many organizations choose the BILL Platform for Microsoft because it enhances the systems they already rely on. Here are some common benefits:

- Efficiency: Automating repetitive tasks frees up time for finance teams to focus on more strategic work.

- Accuracy: Reducing manual data entry lowers the risk of human error.

- Visibility: Real-time dashboards help leaders understand the company’s financial health at a glance.

- Compliance: Keeping thorough, consistent records makes meeting audit and reporting requirements easier.

Because the platform fits smoothly into Microsoft’s ecosystem, businesses do not have to replace their existing tools. They can extend them.

Is the BILL Financial Operations Platform Right for You?

If your business uses Microsoft Dynamics 365, Business Central, or other Microsoft financial solutions, the BILL Platform could be a good match. It’s built for organizations that want better control over financial processes without adding complexity.

The platform is also scalable. Whether you have a small finance team or a large department, you can adjust the workflows and settings to match your needs.

Final Thoughts

The BILL Financial Operations Platform for Microsoft offers a clear path to more efficient financial management. By automating everyday tasks and connecting key systems, it helps businesses improve accuracy, gain better insights, and save time.

Not sure if this solution fits your business?

Contact GEM365 for free to find out if BILL’s Financial Operations Platform is the right move for you and your business.

Table of Contents

Read more

Forbes Reveals the Best Cloud ERP: Here’s Why Business Central Wins

How the Microsoft Power Apps Platform Transforms Manual Processes

Top Power Automate Workflows Every Business Should Use in 2025